Top 10 Questions to Ask Your Financial Advisor: A Comprehensive Guide

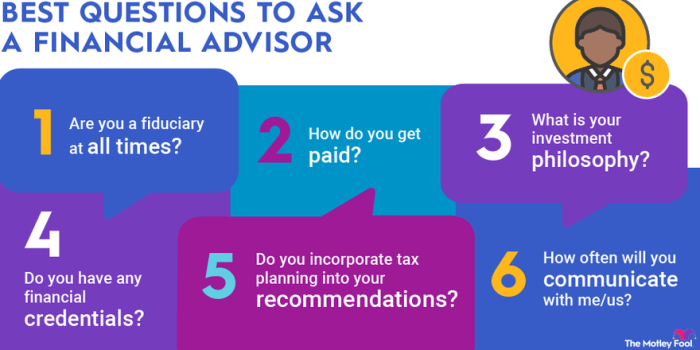

Embark on a journey exploring the Top 10 Questions to Ask Your Financial Advisor, delving into key aspects that can shape your financial planning decisions. As we navigate through the intricate world of financial advisory services, prepare to uncover valuable insights to empower your financial future.

From understanding the role of a financial advisor to evaluating investment strategies and assessing regulatory compliance, this guide aims to equip you with the necessary knowledge to make informed decisions when selecting a financial advisor.

Importance of Financial Advisor

Financial advisors play a crucial role in helping individuals manage their personal finances effectively. They provide expert guidance and advice on various aspects of financial planning, investment strategies, and wealth management.

Role of a Financial Advisor

A financial advisor helps clients create a comprehensive financial plan based on their goals, risk tolerance, and financial situation. They offer personalized recommendations to help individuals make informed decisions about saving, investing, and managing their money.

Benefits of Working with a Financial Advisor

- Expertise: Financial advisors have the knowledge and experience to help clients navigate complex financial matters and make sound financial decisions.

- Customized Solutions: They tailor financial plans to meet the unique needs and goals of each client, providing personalized recommendations for wealth accumulation and preservation.

- Long-Term Planning: Financial advisors assist individuals in setting and achieving long-term financial goals, such as retirement planning, education funding, and estate planning.

- Monitoring and Adjustments: They regularly review and adjust financial plans to ensure they remain aligned with clients' changing circumstances, market conditions, and financial objectives.

- Peace of Mind: By working with a financial advisor, individuals can gain peace of mind knowing that their finances are being managed professionally and effectively.

Qualifications and Experience

When choosing a financial advisor, it is crucial to consider their qualifications and experience to ensure you are receiving sound financial advice.

Key Qualifications to Look For

- CFP (Certified Financial Planner): A CFP designation signifies that the advisor has met rigorous education, examination, experience, and ethics requirements.

- CFA (Chartered Financial Analyst): A CFA designation is recognized globally and indicates expertise in investment management and financial analysis.

- CPA (Certified Public Accountant): A CPA credential is valuable for advisors who specialize in tax planning and financial management.

Importance of Experience

Experience plays a crucial role in the effectiveness of a financial advisor. Advisors with years of experience have likely encountered various financial scenarios and can provide valuable insights and strategies based on real-world situations.

Significance of Certifications

- CFP:Focuses on comprehensive financial planning, including investments, retirement, tax, and estate planning.

- CFA:Specializes in investment analysis and portfolio management, ideal for clients seeking in-depth investment advice.

- CPA:Particularly beneficial for clients requiring tax planning and accounting expertise within their financial advisory services.

Fee Structure and Compensation

When working with a financial advisor, it is crucial to understand the fee structure and compensation models they use. This can impact the quality of advice you receive and the advisor's incentives.

Different Fee Structures

- Fee-Only: Advisors charge a flat fee, hourly rate, or a percentage of assets under management. They do not earn commissions on products sold.

- Commission-Based: Advisors earn commissions on financial products they sell, which can create conflicts of interest.

- Fee-Based: Advisors charge a fee for their advice but may also earn commissions on certain products.

Pros and Cons of Fee-Only vs. Commission-Based

- Fee-Only:

- Pros: Reduced conflicts of interest, transparent pricing, and alignment with client goals.

- Cons: Higher upfront costs, potential for advisor bias towards certain products.

- Commission-Based:

- Pros: No upfront costs for clients, advisors may work harder to earn commissions.

- Cons: Incentivized to sell products for commissions, potential for biased advice.

Impact of Fee Structures on Advice

The fee structure can influence the recommendations and advice provided by financial advisors. Fee-only advisors may focus on holistic financial planning, while commission-based advisors may push products that pay higher commissions. It is essential to understand how your advisor's compensation may impact the advice they give you.

Investment Strategies and Risk Management

When working with a financial advisor, one of the key aspects to consider is the investment strategies they recommend and how they approach risk management in financial planning.

Common Investment Strategies

- Asset Allocation: Financial advisors often recommend diversifying investments across different asset classes such as stocks, bonds, and cash to manage risk and maximize returns.

- Buy and Hold: This strategy involves buying investments and holding onto them for the long term, regardless of short-term market fluctuations.

- Market Timing: Some advisors may attempt to predict market movements and adjust investments accordingly to capitalize on opportunities.

Importance of Risk Management

Risk management is crucial in financial planning to protect your investments and achieve long-term financial goals. It involves assessing the level of risk you are comfortable with and implementing strategies to mitigate potential losses.

Remember, higher returns often come with higher risk, so finding the right balance is key.

Tailoring Investment Strategies

- Risk Tolerance: Financial advisors consider your risk tolerance, which is how much volatility you are willing to endure in your investments, when designing a strategy.

- Financial Goals: Your long-term financial goals, such as retirement planning or saving for a big purchase, also play a significant role in determining the most suitable investment strategy.

Communication and Availability

Effective communication and availability are key factors in maintaining a successful relationship between clients and financial advisors. Clear and regular communication ensures that both parties are on the same page regarding financial goals, strategies, and progress. Accessibility and responsiveness are also crucial in building trust and confidence in your financial advisor.

Importance of Clear Communication

Clear communication helps in establishing and maintaining a strong relationship with your financial advisor. It allows you to express your financial goals, concerns, and preferences effectively, ensuring that your advisor understands your unique situation and can tailor their recommendations accordingly.

Tips for Maintaining Regular Communication

- Schedule regular check-ins: Set up periodic meetings or calls with your financial advisor to review your financial plan and address any questions or concerns.

- Be proactive: Don't hesitate to reach out to your advisor whenever you have a change in financial circumstances or need advice on a particular investment.

- Utilize multiple communication channels: Stay in touch with your advisor through phone, email, or secure messaging platforms to ensure timely responses and updates.

Significance of Accessibility and Responsiveness

When choosing a financial advisor, it is important to consider their accessibility and responsiveness. A responsive advisor who is readily available to address your queries and concerns can provide you with peace of mind and confidence in their expertise. Accessibility ensures that you can reach out to your advisor when you need guidance or advice, especially during critical financial decisions or market fluctuations.

Regulatory Compliance and Disclosures

Financial advisors are required to adhere to strict regulatory requirements to ensure the protection of their clients' interests and maintain the integrity of the financial services industry. These regulations are put in place to promote transparency, ethical conduct, and accountability.

Regulatory Requirements for Financial Advisors

- Financial advisors must be registered with the appropriate regulatory bodies, such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA).

- They are required to disclose any conflicts of interest that may arise from their recommendations and provide clients with all relevant information to make informed decisions.

- Advisors must follow the fiduciary standard, which means they are obligated to act in their clients' best interests at all times.

Importance of Understanding Disclosures

Understanding the disclosures provided by financial advisors is crucial for clients to assess the advisor's potential conflicts of interest, fee structures, investment strategies, and any disciplinary history. It allows clients to make informed decisions and ensures transparency in the advisor-client relationship.

Verifying Compliance with Industry Regulations

- Clients can verify a financial advisor's compliance with industry regulations by checking their registration status with regulatory bodies, such as the SEC or FINRA.

- It is also important to review the advisor's Form ADV, which provides information about their business practices, fees, and any disciplinary actions taken against them.

- Clients can ask the advisor directly about their compliance with regulations and seek clarification on any concerns they may have regarding disclosures.

Performance Evaluation and Reporting

When working with a financial advisor, it is essential to understand how they measure and report the performance of your investments. This information can help you assess the effectiveness of your current financial strategy and make informed decisions moving forward.

Periodic performance evaluations with your financial advisor are crucial for tracking the progress of your investments and ensuring that they align with your financial goals. These evaluations provide valuable insights into the performance of your portfolio and help identify areas that may need adjustment.

Tips for Interpreting Investment Performance Reports

- Review the time period: Pay attention to the timeframe covered in the performance report, as short-term fluctuations may not accurately reflect the overall performance of your investments.

- Understand benchmarks: Compare the performance of your investments to relevant benchmarks to assess how well your portfolio is performing relative to the market.

- Consider risk-adjusted returns: Look beyond simple returns and consider the level of risk taken to achieve those returns, as this can provide a more accurate picture of performance.

- Assess fees and expenses: Take into account the impact of fees and expenses on your investment returns, as high costs can significantly affect your overall performance.

- Seek explanations for underperformance: If certain investments are underperforming, ask your financial advisor for explanations and potential strategies for improvement.

Financial Planning Process

Financial planning is a crucial aspect of managing one's finances effectively. It involves a series of steps that individuals undertake with the help of a financial advisor to create a roadmap for their financial future.

Importance of Setting Clear Financial Goals

Setting clear financial goals is the foundation of any financial plan. It helps individuals identify what they want to achieve financially and provides direction for making informed decisions. Financial advisors play a key role in assisting clients in defining realistic and achievable financial goals based on their unique circumstances and aspirations.

How Financial Advisors Help Create Personalized Financial Plans

Financial advisors work closely with clients to develop personalized financial plans tailored to their specific needs and objectives. They gather relevant information about the client's current financial situation, future goals, risk tolerance, and time horizon. Based on this information, advisors recommend suitable strategies and investment options to help clients meet their financial goals.

By providing ongoing guidance and support, financial advisors help clients stay on track and adapt their plans as needed to navigate changing circumstances.

Client References and Testimonials

When selecting a financial advisor, it is crucial to consider client references and testimonials to gauge the advisor's credibility and reliability. Client feedback can provide valuable insights into the advisor's track record and the level of satisfaction among past and current clients.

Importance of Client References

- Client references offer firsthand accounts of the advisor's performance and professionalism.

- They can help you assess whether the advisor has successfully helped clients achieve their financial goals.

- Client testimonials can highlight the strengths and areas of expertise of the advisor.

Requesting and Evaluating Client References

- Ask the financial advisor for a list of client references and contact information.

- Reach out to these clients to inquire about their experience working with the advisor.

- Consider asking specific questions about the advisor's communication style, investment strategies, and overall satisfaction.

- Look for consistency in feedback and consider the reputation of the advisor within the industry.

Specialization and Expertise

When it comes to choosing a financial advisor, one key aspect to consider is their specialization and expertise in specific areas. Working with a financial advisor who specializes in niche financial areas such as retirement planning or estate planning can offer a range of benefits to clients.

Benefits of Specialization

- Specialized Knowledge: A financial advisor who focuses on a specific area has in-depth knowledge and expertise in that particular field, providing valuable insights and tailored advice.

- Customized Solutions: Specialized advisors can offer customized solutions that align with the client's unique financial goals and circumstances, leading to more effective financial planning strategies.

- Stay Updated: Advisors specializing in niche areas are likely to stay updated on the latest trends, regulations, and strategies within their field, ensuring that clients receive the most relevant and current advice.

Importance of Expertise

Having expertise in niche financial areas is crucial when selecting a financial advisor as it can significantly impact the quality and effectiveness of the financial advice provided. An advisor with specialized knowledge can offer targeted solutions that address specific financial needs and goals, leading to better outcomes for clients.

Value of Specialized Advice

Specialized financial advice can add significant value to a client's financial plan in various scenarios. For example, a retirement planning expert can help clients navigate complex retirement income strategies, optimize Social Security benefits, and manage retirement risks effectively. Similarly, an estate planning specialist can assist clients in creating a comprehensive estate plan, minimizing tax liabilities, and ensuring smooth wealth transfer to future generations.

Ending Remarks

Concluding our exploration of the Top 10 Questions to Ask Your Financial Advisor, we have unraveled essential considerations to enhance your financial advisory experience. By arming yourself with these insights, you are better positioned to collaborate effectively with your financial advisor and steer towards your long-term financial goals.

Top FAQs

How can a financial advisor help with long-term financial goals?

A financial advisor can provide strategic guidance and personalized recommendations to align your financial decisions with your long-term objectives, ensuring a structured approach towards wealth accumulation and preservation.

What are the key qualifications to look for in a financial advisor?

Key qualifications include certifications like CFP, CFA, and CPA, indicating expertise in financial planning, investment analysis, and tax matters, respectively.

How do fee structures impact the advice provided by financial advisors?

Fee structures can influence the objectivity of advice, with fee-only models often perceived as more transparent and aligned with clients' interests compared to commission-based compensation.

Why is clear communication crucial between clients and financial advisors?

Clear communication fosters mutual understanding, ensuring that clients' financial goals and preferences are effectively conveyed and addressed by the financial advisor.

How can client references and testimonials aid in selecting a financial advisor?

Client references and testimonials offer insights into the advisor's track record, client satisfaction levels, and overall credibility, aiding in the decision-making process.

What benefits does working with a specialized financial advisor offer?

Specialized advisors bring focused expertise in niche areas like retirement planning or estate planning, providing tailored solutions that cater to specific financial needs and goals.