Is Shopify Capital Loan Right for Your Business?

Is Shopify Capital Loan Right for Your Business? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Shopify Capital Loan is a unique funding option tailored for businesses looking for quick and convenient financial assistance. From eligibility criteria to application processes, this overview covers all aspects to help you determine if it's the right fit for your business.

Introduction to Shopify Capital Loan

Shopify Capital Loan is a financing option offered by Shopify to eligible businesses that use their platform. This loan is designed to provide quick and easy access to capital for business owners looking to grow and expand their operations.

Eligibility Criteria for Shopify Capital Loan

- Active Shopify account

- Minimum qualifying sales volume

- Good standing with Shopify

Benefits of Shopify Capital Loan

- Quick approval process

- No fixed monthly payments

- Flexible repayment based on future sales

- No personal guarantee required

- Access to funds for business growth

Pros and Cons of Shopify Capital Loan

When considering a Shopify Capital Loan for your business funding needs, it is important to weigh the advantages and disadvantages to make an informed decision.

Advantages of Choosing a Shopify Capital Loan:

- Quick and Easy Application Process: Shopify Capital Loans have a streamlined application process, making it convenient for businesses in need of fast funding.

- No Fixed Monthly Payments: Unlike traditional loans, Shopify Capital Loans are repaid through a percentage of daily sales, which can be beneficial for businesses with fluctuating revenue.

- No Credit Check: Shopify Capital Loans do not require a credit check, providing an opportunity for businesses with less-than-perfect credit to access funding.

- Funding Amount Based on Sales History: The loan amount offered is determined based on the business's sales history on the Shopify platform, ensuring a personalized funding approach.

Potential Drawbacks of Shopify Capital Loan:

- Higher Fees: Shopify Capital Loans may come with higher fees compared to traditional loans, which can impact the overall cost of borrowing.

- Limitation to Shopify Merchants: Eligibility for a Shopify Capital Loan is limited to businesses operating on the Shopify platform, restricting access for those using other e-commerce platforms.

- Revenue Sharing Model: Repayment of the loan is structured as a percentage of daily sales, which can potentially impact cash flow if sales are inconsistent.

Comparison with Other Financing Options:

When comparing Shopify Capital Loans with other financing options available to businesses, it is essential to consider factors such as interest rates, repayment terms, eligibility requirements, and funding speed. Traditional bank loans may offer lower interest rates but come with stricter qualification criteria and longer processing times.

Alternative lenders may provide quicker funding but at higher costs. Crowdfunding and peer-to-peer lending platforms offer alternative funding options but require successful campaign execution.

Application Process for Shopify Capital Loan

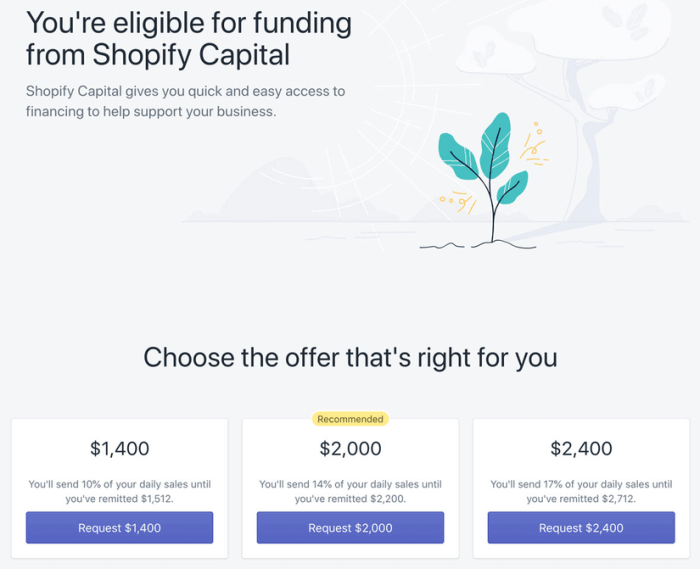

Applying for a Shopify Capital Loan can be a straightforward process if you have all the necessary information and documentation ready. Here is a step-by-step guide on how to apply for a Shopify Capital Loan and increase your chances of approval.

Step-by-Step Guide to Applying for a Shopify Capital Loan

- Create a Shopify account: To be eligible for a Shopify Capital Loan, you need to have an active Shopify account.

- Check your eligibility: Shopify will determine your eligibility based on your store's performance and transaction history.

- Access the capital tab: If you are eligible, you will see the Capital tab in your Shopify dashboard. Click on it to start the application process.

- Review your offer: Shopify will present you with a loan offer based on your store's performance. Review the terms and conditions carefully.

- Accept the offer: If you are satisfied with the offer, you can accept it and proceed to the next steps.

- Complete the application: Fill out the necessary information and submit any required documentation to complete the application process.

- Wait for approval: Once you have submitted your application, Shopify will review it and notify you of their decision.

- Receive funds: If your application is approved, the funds will be deposited into your bank account within a few business days.

Documentation Requirements and Tips for Approval

- Documentation:You may be required to submit documents such as bank statements, tax returns, and proof of identity to support your application.

- Information needed:Shopify may ask for details about your business, revenue, and future plans to assess your creditworthiness.

- Tips for approval:To increase your chances of approval, ensure that your store has a consistent revenue stream, maintain good customer reviews, and provide accurate and up-to-date information in your application.

Managing Shopify Capital Loan

When it comes to managing a Shopify Capital Loan effectively, businesses need to have a clear strategy in place to ensure the funds are utilized properly and the loan is repaid on time. In this section, we will discuss strategies for managing the funds, repayment terms, interest rates, fees, and share some success stories of businesses that have benefited from a Shopify Capital Loan.

Effective Fund Management

- Develop a detailed budget: Create a budget outlining how the loan funds will be used to achieve specific business goals. This will help in tracking expenses and ensuring funds are allocated wisely.

- Monitor cash flow: Regularly monitor cash flow to ensure that there is enough revenue to cover loan repayments and other business expenses.

- Invest in growth: Use the loan funds to invest in areas of the business that will generate a return on investment, such as marketing, inventory, or equipment.

- Reinvest profits: Once the loan is repaid, consider reinvesting profits back into the business to continue its growth and success.

Repayment Terms, Interest Rates, and Fees

- Repayment terms: Shopify Capital Loans typically have fixed daily repayments, which are automatically deducted from the business's Shopify sales. This can help in managing cash flow effectively.

- Interest rates: The interest rates for Shopify Capital Loans are fixed, providing businesses with predictability in terms of repayment amounts.

- Associated fees: Shopify Capital Loans do not have any hidden fees or upfront costs, making it a transparent financing option for businesses.

Success Stories

One success story involves a small e-commerce business that used a Shopify Capital Loan to invest in a new product line. The business saw a significant increase in sales and was able to repay the loan ahead of schedule, leading to further expansion opportunities.

Another business used the loan to upgrade their website and improve their online marketing strategies. This resulted in higher conversion rates and increased revenue, showing the positive impact of strategic fund management.

Summary

In conclusion, Is Shopify Capital Loan Right for Your Business? delves into the intricacies of this funding solution, shedding light on its benefits and considerations. Whether you're a small startup or an established company, exploring this financing avenue could pave the way for enhanced growth and success.

Top FAQs

What are the eligibility criteria for a Shopify Capital Loan?

Businesses must have a track record of consistent sales on Shopify to qualify for a Shopify Capital Loan.

What are the advantages of choosing a Shopify Capital Loan?

Unlike traditional loans, Shopify Capital Loans offer quick approval, flexible repayment options, and no fixed monthly payments.

How can businesses increase their chances of approval for a Shopify Capital Loan?

Maintaining a healthy sales history on Shopify, providing accurate financial information, and ensuring compliance with Shopify's terms and conditions can boost approval odds.