How to Qualify for Shopify Capital Financing: A Comprehensive Guide

Delving into the realm of Shopify Capital Financing opens up a world of opportunities for businesses looking to expand. From understanding the basics to navigating the application process, this guide covers everything you need to know to secure the funding your business deserves.

Exploring the specific requirements and financial metrics involved in qualifying for Shopify Capital Financing sheds light on the path to financial growth and success.

Understanding Shopify Capital Financing

Shopify Capital Financing is a financial service offered by Shopify to help eligible businesses access funding for their operations and growth. Unlike traditional loans, this financing option is tailored specifically for Shopify merchants.

Benefits of Shopify Capital Financing

- Quick access to funds without lengthy approval processes

- Flexible repayment options based on a percentage of daily sales

- No fixed monthly payments or interest rates

- Ability to invest in inventory, marketing, or other business needs

Eligibility Criteria for Shopify Capital Financing

- Active Shopify store with a minimum sales history

- Consistent revenue generation and growth potential

- Compliance with Shopify's terms of service and policies

- Good standing with Shopify Payments or other payment providers

How Shopify Capital Financing Differs from Traditional Loans

- Based on sales performance rather than credit score

- No fixed repayment schedule or interest rates

- Quick approval process with funds deposited directly into your Shopify account

- Repayment through a percentage of daily sales, making it more manageable for businesses

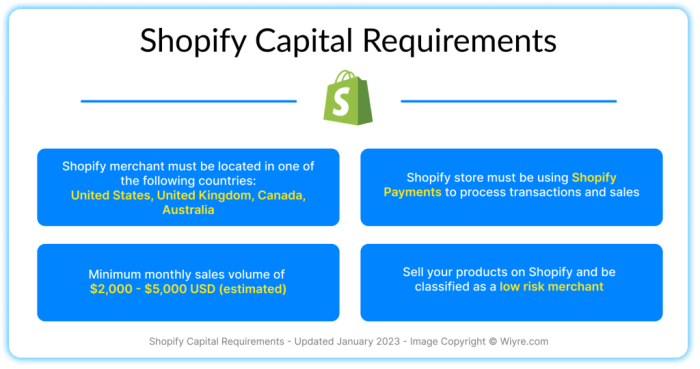

Qualification Requirements

To qualify for Shopify Capital Financing, there are specific requirements that need to be met. These criteria determine the eligibility of merchants to receive funding for their businesses.

Documentation and Information Needed

- Active Shopify account with a history of sales

- Minimum monthly revenue threshold

- Details of business performance and sales history

- Personal and business credit history

Comparison to Other Funding Options

When compared to traditional loans or other funding options, Shopify Capital Financing offers a streamlined process that leverages the merchant's sales data on the platform. This can make it easier for businesses to qualify based on their performance within the Shopify ecosystem, rather than relying solely on credit scores or collateral.

Financial Metrics and Performance

When it comes to qualifying for Shopify Capital Financing, your financial metrics and performance play a crucial role in the evaluation process. These metrics give Shopify insight into your business's financial health and its ability to repay the loan.

Importance of Revenue, Order Volume, and Growth Rate

- Revenue: Shopify looks at your business's revenue to determine its stability and profitability. Higher revenue indicates a healthy cash flow and the ability to generate income to repay the loan.

- Order Volume: The number of orders your business receives is a key indicator of customer demand and sales potential. A high order volume demonstrates strong customer interest and growth opportunities.

- Growth Rate: Shopify assesses your business's growth rate to evaluate its scalability and potential for expansion. A high growth rate signals a thriving business with promising future prospects.

Tip: To improve your financial metrics and increase your chances of qualifying for financing, focus on increasing revenue through marketing strategies, optimizing order fulfillment processes to boost order volume, and implementing growth initiatives to accelerate business growth.

Application Process

Applying for Shopify Capital Financing is a straightforward process that can help you secure the funds you need to grow your business. Here's a guide on how to navigate the application portal on Shopify and some common mistakes to avoid during the application process.

Step-by-Step Guide

- Create a Shopify account: Before applying for financing, make sure you have a Shopify account set up.

- Check eligibility: Review the qualification requirements to ensure your business meets the criteria for Shopify Capital Financing.

- Access the Capital page: Go to your Shopify dashboard and navigate to the Capital tab to start the application process.

- Fill out the application: Provide accurate and detailed information about your business, revenue, and financial history.

- Submit your application: Double-check all the information before submitting your application for review.

- Wait for approval: Once you've submitted your application, wait for Shopify to review and approve your request for financing.

Common Mistakes to Avoid

- Providing inaccurate information: Make sure all the details you provide in your application are correct and up to date.

- Not meeting eligibility requirements: Ensure your business meets the necessary criteria before applying for financing.

- Missing documents: Be sure to include all required documents and information to support your application.

- Ignoring communication: Stay responsive to any requests for additional information or clarification during the application process.

Accepting and Managing Funds

Accepting funding from Shopify Capital is a straightforward process. Once your application is approved and you receive the offer, you can review the terms and conditions online. If you choose to accept the offer, the funds will be deposited directly into your business bank account.

Effectively Managing Received Funds

When it comes to managing the funds you receive from Shopify Capital, it is essential to have a clear plan in place. Here are some insights on how to effectively manage the funds:

- Develop a detailed budget outlining how you plan to allocate the funds.

- Track your expenses and monitor your cash flow regularly to ensure you are staying on track.

- Consider investing in areas of your business that will provide a high return on investment, such as marketing, inventory, or technology upgrades.

- Stay disciplined and avoid using the funds for personal expenses or non-business related activities.

Best Practices for Utilizing Funds to Grow Your Shopify Business

To maximize the impact of the funds you receive from Shopify Capital, consider the following best practices:

- Invest in marketing strategies to attract more customers and drive sales.

- Upgrade your e-commerce platform or invest in new technology to improve the customer experience.

- Expand your product line or inventory to cater to a wider range of customers.

- Consider hiring additional staff or outsourcing tasks to free up more time to focus on growing your business.

Last Word

In conclusion, mastering the art of qualifying for Shopify Capital Financing can pave the way for significant business growth and development. By understanding the eligibility criteria, financial metrics, and application process, businesses can position themselves for success in the competitive market landscape.

FAQ Corner

What is Shopify Capital Financing?

Shopify Capital Financing is a funding option provided by Shopify to help businesses grow by offering advances based on their future sales.

How does Shopify Capital Financing differ from traditional loans?

Unlike traditional loans, Shopify Capital Financing does not require a credit check and is based on a business's sales history on the Shopify platform.

What are some examples of documents needed for the application process?

Documents such as bank statements, sales reports, and identification may be required for the application process.

How can businesses improve their financial metrics to qualify for financing?

Businesses can improve their financial metrics by increasing revenue, order volume, and growth rate, which are key factors in the evaluation process.