Starting with the question 'Is Shopify Capital Loan Right for Small Businesses?', this introduction aims to pique the interest of the readers with a detailed yet engaging overview of the topic.

The following paragraph will delve into the specifics and nuances of Shopify Capital Loan, shedding light on its workings and benefits for small businesses.

Overview of Shopify Capital Loan

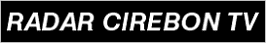

Shopify Capital Loan is a financing option offered by Shopify to help small businesses access the funds they need to grow and expand their operations. Unlike traditional loans, Shopify Capital Loan is tailored specifically for merchants on the Shopify platform.

How Shopify Capital Loan Works

When a small business qualifies for a Shopify Capital Loan, the funds are deposited directly into their Shopify account. The loan amount is then repaid through a percentage of the business's daily sales on Shopify. This means that the repayment amount adjusts based on the business's revenue, making it more flexible than fixed monthly payments.

Eligibility Criteria

- Must be a registered business on the Shopify platform

- Minimum revenue threshold

- Good standing with Shopify Payments

Benefits of Shopify Capital Loan

- Quick approval process

- No fixed monthly payments

- Flexible repayment based on daily sales

- No interest rates or personal guarantees

- Opportunity for business growth and expansion

Pros and Cons of Shopify Capital Loan

When considering a Shopify Capital Loan for your small business, it is essential to weigh the advantages and disadvantages to make an informed decision.

Advantages of Shopify Capital Loan

- Quick and Easy Access to Funds: Shopify Capital offers a streamlined application process, providing fast access to the funds your business needs.

- No Fixed Monthly Payments: Unlike traditional loans, Shopify Capital Loan repayments are based on a percentage of your daily sales, making it more flexible for businesses with fluctuating revenue.

- No Credit Check: Shopify Capital does not require a credit check, making it accessible to businesses with less-than-perfect credit scores.

- No Interest Rates: Instead of interest rates, Shopify Capital charges a fixed fee, allowing you to know the total cost upfront.

- Integration with Shopify Platform: Since Shopify Capital is integrated with your Shopify store, repayments are automatically deducted from your sales, simplifying the process.

Drawbacks of Shopify Capital Loan

- Higher Fees: While Shopify Capital does not charge interest rates, the fixed fee can sometimes be higher than traditional loan interest rates.

- Revenue Sharing: Repayments are based on a percentage of your daily sales, which means during slower periods, you may end up paying a higher percentage of your revenue.

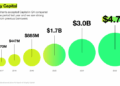

- Limitations on Loan Amounts: Shopify Capital Loan amounts are based on your store's sales history, which may limit the amount you can borrow.

Comparison with Other Small Business Loans

- Traditional Bank Loans: Shopify Capital Loan offers a quicker and more accessible application process compared to traditional bank loans, making it ideal for businesses in need of immediate funding.

- Online Lenders: While online lenders may offer competitive rates, Shopify Capital's integration with your Shopify store and automated repayments provide added convenience.

- Peer-to-Peer Lending: Shopify Capital Loan eliminates the need to involve multiple investors or lenders, streamlining the borrowing process for small businesses.

Application Process and Requirements

When it comes to applying for a Shopify Capital Loan, the process is relatively straightforward

Application Steps

- Create a Shopify store: To be eligible for a Shopify Capital Loan, you must have an active Shopify store. If you don't have one already, you'll need to set it up first.

- Check eligibility: Shopify will assess your store's performance to determine if you qualify for a loan. Factors like your sales history, the consistency of your revenue, and other metrics will be taken into account.

- Receive an offer: If you're eligible, Shopify will make you a loan offer based on your store's performance. You can review the terms and decide whether to accept the offer.

- Accept the offer: If you decide to proceed, you can accept the loan offer directly through your Shopify account.

- Provide documentation: You may need to submit additional documentation to complete the application process, such as bank statements or financial records.

Requirements and Documentation

- Active Shopify store: You must have an active Shopify store to be eligible for a loan.

- Sales history: Shopify will review your store's sales history to assess your eligibility.

- Business information: You may need to provide details about your business, such as your company structure and revenue.

- Financial records: You may be required to submit bank statements or other financial documents to support your application.

Approval and Disbursement

Once you've completed the application process and provided all necessary documentation, Shopify will review your application and make a decision. If approved, funds are typically disbursed quickly, often within a few business days. The exact timeline may vary based on the amount of the loan and other factors.

Repayment Terms and Conditions

When it comes to repaying a Shopify Capital Loan, small businesses have several options available to make the process as manageable as possible. Let's take a closer look at the repayment terms and conditions.

Interest Rates and Fees

- Shopify Capital Loans do not have a set interest rate, as they operate on a fixed fee structure. This means that the fee charged is a one-time fixed amount, rather than a fluctuating percentage based on the loan amount.

- The fixed fee is determined upfront when the loan is issued, allowing small businesses to know exactly how much they will need to repay without the uncertainty of variable interest rates.

- There are no additional interest charges or hidden fees associated with Shopify Capital Loans, providing transparency and predictability for borrowers.

Flexibility in Repayment Terms

- Shopify offers flexibility in repayment terms by automatically deducting a percentage of daily sales until the loan is repaid in full.

- This repayment method is ideal for businesses with fluctuating sales volumes, as the amount deducted adjusts based on daily revenue.

- Small businesses can also choose to repay the loan early without any prepayment penalties, helping them save on overall repayment costs and potentially accessing future funding sooner.

Closing Notes

Concluding our discussion on the suitability of Shopify Capital Loan for small businesses, this section will provide a concise summary of the key points discussed, leaving readers with a lasting impression.

FAQ Compilation

Is there a minimum credit score required to apply for a Shopify Capital Loan?

Yes, Shopify requires a minimum credit score of 600 for small businesses to be eligible for their Capital Loan.

What are the repayment terms like for a Shopify Capital Loan?

Repayment terms for a Shopify Capital Loan are flexible and can be customized based on the business's revenue.

Are there any penalties for early repayment of a Shopify Capital Loan?

No, there are no penalties for early repayment, allowing businesses to save on interest costs.