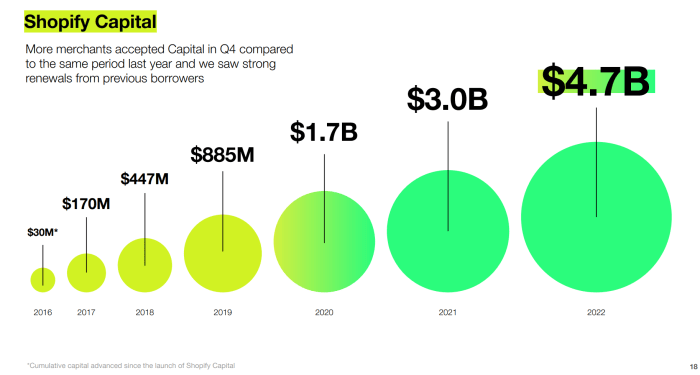

Embark on a journey through the intricacies of Shopify Capital Loan Explained: Pros, Cons & Best Practices, where we unveil the benefits, drawbacks, and best strategies for leveraging this financial tool.

Delve into the specifics of how businesses can access and utilize funds through Shopify Capital Loan to propel their growth and success.

Introduction to Shopify Capital Loan

Shopify Capital Loan is a financing option offered by Shopify to help businesses grow and expand. It provides eligible merchants with a lump sum of money that is repaid through a percentage of their daily sales on the platform.

Eligibility Criteria for Shopify Capital Loan

- Must be a registered Shopify merchant

- Have a minimum of 6 months of sales history on the platform

- Meet certain revenue requirements set by Shopify

Utilizing Funds from a Shopify Capital Loan

Businesses can use the funds from a Shopify Capital Loan for various purposes, such as:

- Launching marketing campaigns to reach a wider audience

- Investing in inventory to meet customer demand

- Expanding product lines or introducing new products

- Improving website design or user experience

Pros of Shopify Capital Loan

Shopify Capital Loan offers several advantages that make it a preferred choice for many businesses looking for funding to grow.

Flexible Repayment Options

One of the main pros of Shopify Capital Loan is the flexibility it offers in terms of repayment. Businesses can repay the loan through a percentage of their daily sales, making it easier to manage cash flow.

No Fixed Monthly Payments

Unlike traditional loans, Shopify Capital Loan does not require fixed monthly payments. This can be beneficial for businesses with fluctuating sales, as they can adjust their payments based on their revenue.

Quick Approval Process

Shopify Capital Loan has a quick approval process, allowing businesses to access funds in a timely manner. This can be crucial for businesses looking to seize growth opportunities or address urgent financial needs.

No Personal Guarantee

Another advantage of Shopify Capital Loan is that it typically does not require a personal guarantee. This means business owners are not personally liable for the loan, reducing their personal financial risk.

Success Stories

Many businesses have successfully grown and expanded with the help of a Shopify Capital Loan. For example, a small online retailer was able to increase inventory and launch new marketing campaigns, leading to a significant increase in sales and profitability.

Cons of Shopify Capital Loan

While Shopify Capital Loan offers several benefits, there are also some potential drawbacks and risks that businesses should consider before taking one.

Impact of Repayment Terms

The repayment terms of a Shopify Capital Loan can sometimes be challenging for businesses, especially if they are experiencing fluctuations in their cash flow. The fixed percentage of daily sales that goes towards repayment can put a strain on finances, making it difficult to cover other operational expenses.

Situations Where Shopify Capital Loan May Not Be the Best Option

- For businesses with unpredictable sales patterns: If a company's sales are inconsistent or seasonal, the fixed repayment structure of a Shopify Capital Loan may not be suitable.

- When other financing options offer more flexibility: Businesses should explore alternative financing options that may provide more favorable terms and conditions based on their specific needs.

- High-cost of borrowing: While Shopify Capital Loans are convenient, they may come with higher interest rates compared to traditional bank loans or other forms of financing.

Best Practices for Utilizing Shopify Capital Loan

When it comes to utilizing a Shopify Capital Loan, there are several best practices that businesses can follow to ensure they make the most out of the funding they receive. By implementing these strategies, businesses can effectively manage their finances and maximize the benefits of the loan.

Develop a Clear Plan for Fund Allocation

- Before receiving the funds, create a detailed plan outlining how you intend to allocate the money.

- Identify areas of your business that require investment and prioritize them based on their impact on growth and revenue.

- Allocate funds strategically to ensure that you are using the loan to address key business needs and opportunities.

Focus on Revenue-Generating Activities

- Use the funds to invest in activities that will directly contribute to increasing your revenue and profitability.

- Consider initiatives such as marketing campaigns, product development, or expanding your product line to drive sales and growth.

- Avoid using the funds for non-essential expenses that do not directly impact your bottom line.

Monitor Financial Performance Closely

- Regularly track and analyze your financial performance to ensure that you are on track to meet your business goals.

- Use key performance indicators (KPIs) to measure the effectiveness of your investments and adjust your strategy as needed.

- Stay proactive in managing your finances to ensure that you can repay the loan on time and in full.

Last Point

In conclusion, Shopify Capital Loan offers a unique opportunity for businesses to secure funding and optimize their financial strategies. By understanding the pros, cons, and best practices, businesses can make informed decisions to drive their growth and profitability.

Frequently Asked Questions

What is the minimum credit score required to apply for a Shopify Capital Loan?

The minimum credit score required is typically around 550, but meeting this threshold does not guarantee approval. Other factors are also considered in the application process.

Can a business apply for multiple Shopify Capital Loans simultaneously?

No, Shopify typically allows one active loan per business at a time. However, once a loan is repaid, businesses can apply for a new one if eligible.

Are there any penalties for early repayment of a Shopify Capital Loan?

Shopify Capital Loans do not have penalties for early repayment. In fact, early repayment can help businesses save on interest costs.